RECONATOR - OpenTeQ’s Advanced Reconciliation Overview

OpenTeQ’s RECONATOR solution automates general ledger account reconciliations, including bank reconciliations, credit card matching, intercompany transactions, account receivables and payables, and invoice-to-PO matching, all in one centralized workspace. With OpenTeQ’s Account Reconciliation, errors and manual ticking and tying are removed so accounting teams can focus on exceptions, high-risk reconciliations, and other strategic work.

Automated reconciliation Accurate reports

Automate your reconciliations, provide more accurate financial reports and ensure auditability with Vena for Account Reconciliation.

Accelerate Your Financial Reconciliation

Our account reconciliation software includes templates for specialized reconciliations like prepaid expenses, fixed assets and bank reconciliations. Use our GL to subledger template for standard reconciliations like accounts receivable, payables and more.

Save Time With Automated Reconciliations

Post matching entries automatically, flagging only the accounts that need review and reconciliation on the part of your accounting team.

Increase Transparency With Supporting Documents

Attach supporting calculations and documentation to quickly explain each exception to auditors, management, regulators and other stakeholders.

Track All Your Reconciliations With a Central Template

See which accounts have been reconciled and reviewed—and track account balances, reconciling amounts and submitters and reviewers within a central template.

RECONATOR Features that Support businesses

Streamline, standardize, and automate account reconciliations and transaction-matching processes, and eliminate error-prone spreadsheets.

Automated Reconciliation

RECONATOR solution automates the reconciliation process by matching payments received from franchisees with corresponding invoices or sales transactions in the system. This automation reduces manual effort and minimizes errors, improving efficiency and accuracy in the reconciliation process.

Match Payments to Invoices/Transactions

RECONATOR solution compares payment records against invoices, sales transactions, and other financial documents to ensure that payments are correctly attributed and accounted for. Verify that the amounts paid match the amounts owed, considering any discounts, refunds, or adjustments.

Integration with Payment Gateways

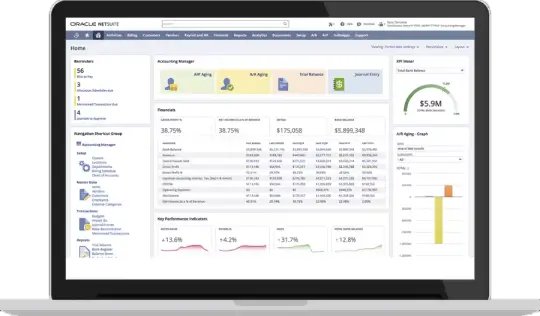

RECONATOR solution integrates with various payment gateways and processors, allowing franchisees to make payments electronically through credit cards, ACH transfers, or other payment methods. These payments are automatically recorded in NetSuite, streamlining the reconciliation process.

Bank Reconciliation

RECONATOR bank reconciliation feature reconciles payments received from franchisees with corresponding bank deposits, ensuring that all transactions are accounted for, and discrepancies are identified and resolved promptly.

4-4-5 Accounting Reports

RECONATOR 4-4-5 reporting module provides businesses with a structured framework for financial reporting and analysis, enabling them to monitor performance, manage resources effectively, and make informed business decisions.

Workflow Automation

RECONATOR workflow automation features can streamline the payment reconciliation process by automating tasks such as approval workflows, notification alerts for overdue payments, and scheduled reconciliation activities.

Benefits of using OpenTeQ’s RECONATOR

Close Faster. Standardize and automate account reconciliations and transaction matching.

Speed Transaction Matching. Fully automate time-consuming, repetitive reconciliations, such as zero-balance, low-value, or low-risk reconciliations, based on rules you set.

Strengthen Internal Controls and SOX Compliance. Easily access archived electronic copies of supporting documentation at the account level.

Financial Statement Accuracy. Reconciling GL accounts ensures any discrepancies or omissions in financial records are caught, reducing the risk of financial misstatements.

Single Solution. Manage and view the status and details of each account with balance comparisons, preparers, reviewers, and sign-off dates.